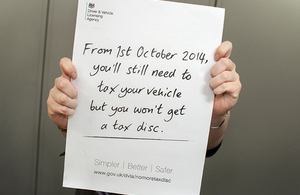

Vehicle tax changes

Posted 06/10/2014

From 1 October 2014, the paper tax disc will no longer need to be displayed on a vehicle. If you have a tax disc with any months left to run after this date, then it can be removed from the vehicle and destroyed. This includes customers with a Northern Ireland address, however they will still need to display their MoT disc.

Buying a vehicle: From 1 October, when you buy a vehicle, the vehicle tax will no longer be transferred with the vehicle. You will need to get new vehicle tax before you can use the vehicle.

Selling a vehicle: From 1 October, vehicle tax is not transferable so you won’t be able to include any remaining tax when you sell a vehicle. If you sell a vehicle after 1 October and you have notified DVLA, you will automatically get a refund for any full remaining months left on the vehicle tax. The refund will be sent to the keepers details on DVLA records so you need to make sure that these are correct.

Vehicle tax refunds: You will no longer need to make a separate application for a refund of vehicle tax.

Parking permits or car parking spaces: All local authorities have been informed that no tax discs will be issued after 1 October 2014.

Driving your vehicle abroad: DVLA have informed the European Union that from 1 October 2014, UK registered vehicles that are travelling in the EU will not display tax discs.

Paying vehicle tax by Direct Debit: From 1 October 2014 (5 October if setting up at a Post Office®), Direct Debit will be offered as an additional way to pay for vehicle tax.

To find our more please read the full article: https://www.gov.uk/government/news/vehicle-tax-changes

Back to Latest News

Get a Quote